What drives change in Healthcare?

Dynamics and secular trends impacting healthcare

Healthcare - big, complex, labour driven, dominated by science, public and private, digitalized and yet still recessive, awe inspiring, (com-) passionate, mission critical, charitable and being a huge corporate industry globally. It’s so many things and fits so few stereotypes that sometimes it feels like a universe in itself. Yet, it is also deeply rooted in our societies, realities and economies, and is subject to strong external forces and trends that impact its trajectory.

When building strategies in healthcare technology it is always helpful to keep in mind the global environment and relevant mega-trends which are impacting this market more than others.

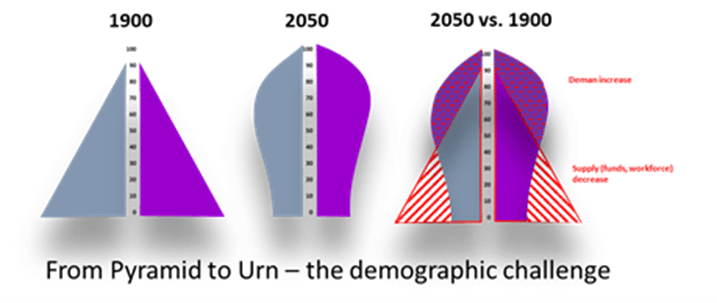

One overarching trend which is shaping the underlying changes in our societies and which is having an imperative impact on healthcare is: demographics. Most industrialized countries have entered into an aging phase of their population’s structure. Some are already even shrinking in absolute numbers, many will follow, and more than a few previously “young” emerging markets show patterns of entering into this transition faster than the old world has done before. Some have called it the movement “from pyramid to urn”, word-playing on the change in the shape of the ancient population pyramid. [1]

The good news for healthcare is the prospect of a decades long growth in demand as the number of aging people keeps growing[2] and with it the need for healthcare in every form. Accepting the reality that the overwhelming majority of health services are delivered to the population past the working age, the extension of life expectancy will over-proportionately extend the demand for healthcare delivery services. At the same time however the supply of resources – both in terms of funds through tax, insurance or social security payments procured from the working population as well as the simple availability of workforce to deliver healthcare services[3] – keeps shrinking. All other things equal, healthcare is thus bound to enter an age of overconsumption and underfunding, which will provide a dangerously unbalanced lever to society.

This dynamic is aggravated by two additional next level developments. Taking cancer therapy as an example, it was not surprising to hear the WHO cautioning against an increase in cancer cases by 60% by 2040.[4] At the same time cancer therapy is making great strives to improve and has already turned several cancer types into ”increasingly becoming a chronic illness”[5] – at the expense of a significant increase in cost per case. The amazing and encouraging rate of successful innovation combined with the “natural” increase in cases is therefore unfortunately also putting more strain on the stretched healthcare funding in most countries.

At the same time, we continue to read more and more about the workforce challenges arising from the generations X, Y and Z. Whether the changes in work-life balance, working-lifetime and working attitude are real is highly debatable. What is not is the material reduction in available resources.[6] Viewed from a global standpoint even immigration, if it will resolve that issue at all, will only move the problem from one place to another. The reality of healthcare having to find sustainable ways to increase its macro-productivity (and its micro-efficiency) is undeniably catching up with us now.

There is however no reason for doom and gloom. These levers are not only great news for us as a population that will, on aggregate, enjoy longer and healthier lives. They are also the impetus for innovation much needed by a largely conservative and change/risk adverse environment in healthcare. Modernization is a must to meet the evolving challenges - not only through innovation in diagnostics and therapies, but also in process, coordination, incentive structures and organization. Technology will be both an enabler as well as beneficiary of these reforms and transformative processes – for example, in facilitating comprehensive care, providing data liquidity or enabling effective telemedicine, prevention and population or disease management.

In addition to the demographic mega-trend which will influence both demand and supply side dynamics in healthcare for decades to come, we see three more specific trends that will impact healthcare markets and customers, and thus strategies: (i) evolving technology, (ii) personalized medicine, (iii) continuously tightening regulation, and (iv) , regionalization of healthcare delivery.

Technology

The technology promise is growing. Whether it is more (and cheaper) sensors, low energy Bluetooth, machine vision, 3D printing, robotics or 5G, options to build out meaningful use cases through cost competitive technology are growing ever more abundant. With the initial build out of a reliable 5G infrastructure, the potential to connect all these use cases in real time is just around the corner. At the same time, medical devices (not long ago significantly high cost items) are commoditizing fast, freeing up budgets for next generation solutions. Technology will soon be able to offer digital data collection at the point of care along the patient’s journey like never before. Technology is only an option or potential though. What are the use cases that create benefit and purpose?

Personalized Medicine

For the best part of 30 years, genomics, biomics and personalized medicine have been the promise and the expectation of innovation in healthcare. Unfortunately, until recently relatively little had been fulfilling that promise. The tide is changing, however, and personalized medicine is coming out of the trough of disillusionment. From immune therapy, personalized radio therapy to 3D reconstruction and tailored prosthesis’, more and more therapies are coming out of the labs and gaining real life approval. The increasing specificity to patient segments of new molecules in pharma research adds to that trend.

Personalized medicine, in the widest sense, is data hungry and will increase to be data hungry. Longitudinal medical data, for a long time believed to be valuable, but never monetized, is suddenly becoming essential. Essential in finding relevant patterns for specific therapies and molecules to be effective in; essential in testing new approaches against relevant patient groups and proofing the benefits (which are otherwise in danger of being diluted with the wrong targets); essential to decision support clinicians, enabling them to find the right treatment for the right patient. With personalized medicine, medical data suddenly has a real and not just assumed value.

The growing ability to generate, collect, harmonize and analyse data at the point of care, and the growing diagnostic and therapeutic demand for that data will, in combination, drive the next round of digitalization in the clinical space. Some may say, finally!

Last, but not least, there are two more very important trends gaining momentum in the healthcare vertical itself. The simple one is regulation.

Continuously Tightening Regulation

With the increasing complexity of both the demand and the provision of healthcare services, the pressure on regulators to risk-manage healthcare will not relax. From a health technology (especially software) perspective the most important regulation is of course the European Union’s medical device directive (MDR)[7] - which is moving many previously unregulated software solutions into the medical device space. Although the European Commission has granted four more years of transition[8], the regulation is coming, like it or not.

Medical device (MD) development means the end of the (much admired) agile development approach and will demand more planning and documentation upfront. Although this feels like a steep hill to climb for many software development organizations, if processes are reviewed and updated, especially the product management and requirement engineering processes, added with some discipline, MD development is neither rocket science nor increasing development cost significantly.

Regionalization of Healthcare Delivery

Another strong dynamic inside the healthcare vertical is an increasing and sustaining regionalization of healthcare provision. With more private ownership structured health economies, like the US, Germany or Switzerland, struggling to outperform public healthcare systems – especially when comparing input-output-ratios – and populations continuing to be attached to public healthcare, we are unlikely to see a move away from public healthcare provision in most mature economies in the near future (emerging and developing countries often have a different history and are in a different stage).

In order to combine economies of scale effects with the avoidance of inefficiencies of centralization, we will continue to see the establishment of regional healthcare provision clusters. The move is trying to marry critical mass with customer (i.e. patient) proximity and will also increasingly allow inter-sectoral coordination and collaboration – an area where we believe the largest productivity reserves remain.

Both vertical dynamics – regulation and regionalization – will be a push for healthcare technology suppliers to professionalize and increase their critical mass. Medical device development processes, albeit not rocket science, require a certain level of coordination, planning and quality control that demands a minimum critical mass from development organizations.

Regional healthcare provision clusters will also create regional procurement and, not the least, IT organizations and capabilities, that will require minimum levels of economic reliability, cloud or hosting options, professional tender replies, long term visions and solution roadmaps from their suppliers. Regionalization is a pan-European trend from the Nordics through the British Isles, Benelux, France, Spain, Italy, etc. [9] and cannot be underestimated in its push for professionalization and critical mass on technology suppliers.

Summary

When demographics continue to accelerate demand for healthcare provision services while the same dynamic creates a gap in resources – funding and workforce – we strongly believe that systemic productivity increases in healthcare are inevitable. Without technology there will not be more productivity gains. The Germans may have achieved the most effective paper-based health system possible, but even there the ceiling is reached.

The next generation of diagnostics and therapies (whether pharma, gene-therapy or devices) all demand more data in order to be effective and efficient. The pull for data is met with an increasing reservoir of technology offerings to enhance, innovate and roll out further digital use cases in healthcare. Together these trends portend an imminent next wave of digitalization.

When developing strategies to harvest the opportunities that are emerging, it will be important to also reflect on the two significant internal dynamics in European healthcare (and beyond): growing regulation and maturing regionalization. Both will create a push for larger, mature supplier organizations and will, slowly but surely, push for a consolidation of the local, relationship based and fragmented, healthcare technology markets in Europe.

Great times ahead for those to become successful, who know what to leave to chance.

[1] Practically all OECD countries show secularly aging populations with most accelerating in the last 10 years, incl. countries with interim shrinkage of average age (e.g. Spain, Russia) with Germany and Japan being the oldest societies. (https://data.oecd.org/pop/elderly-population.htm)

[2] By 2050 population above 65 will increase over 2018 by 28% in Germany, 45% in France, 51% in the UK or 59% in the US with an average of 51%. (https://stats.oecd.org/Index.aspx?DataSetCode=POP_PROJ#)

[3] The OECD predicts a reduction in working age people for Germany from 49m in 2018 to 38m in 2050. (https://stats.oecd.org/Index.aspx?DataSetCode=POP_PROJ#)

[4] https://www.who.int/news-room/detail/04-02-2020-who-outlines-steps-to-save-7-million-lives-from-cancer

[5] https://eu.usatoday.com/story/money/2020/02/05/states-with-the-lowest-and-highest-cancer-rates/41108601/

[6] Just one example: https://www.healtheuropa.eu/nhs-staffing-crisis-a-critical-exception-to-the-immigration-rules/97745/

[7] https://www.johner-institute.com/articles/regulatory-affairs/and-more/mdr-rule-11-software/

[8] https://www.medtechdive.com/news/eu-parliament-set-to-adopt-mdr-class-i-device-compliance-delay/569234/

[9] Whether it is regions and county councils in most of the Nordics, ICGs, CCGs, STPs and Trusts in the UK, ARS and GHTs in France, Autonomic Health Services in Spain, Regions in Italy, etc. most public health systems in Europe intensify their regional set ups.